Tax Evasion

https://www.humantruth.info/tax_evasion.html

By Vexen Crabtree 2021

#bahamas #bermuda #british_virgin_islands #cayman_islands #civilisation #crime #democracy #economics #globalism #governance #indonesia #inequality #internationalism #ireland #malta #mauritius #multinationals #netherlands #panama #tax #tax_evasion #tax_havens #USA

Civilisation relies upon taxation. Workforces are educated, nations are defended. The rule of law, which makes business possible, is secured through state apparatus. The roads on which logistics rely, the national infrastructure that supports electricity and food suppliers, the judicial system: it is all funded through tax. But not all people pay fair. Billionaires manage to pay just 0% to 0.5% of their wealth in tax, significantly less than all others1. The United Nations say that 46% of the world's wealth is owned by the richest 1% of the population2, and economists think somewhere between 10% and 50% of it all is held in tax havens3,4, forcing the poor to pay a much higher proportion and causing true damage to democracies and developing countries alike, generating grievances and resentment5.6

Large multinationals excel at tax evasion by exploiting holes between tax jurisdictions4, by making their accounting artificially complicated7, and by hiding profits in low-tax countries (at a rate of $1 trillion per year)8. Some of the most well-known corporate tax evaders include the tech giants Amazon, Apple, Facebook, Google, Microsoft and Netflix7,9; Nike3, and, the fashion and textile industry as a whole has produced a long and terrible legacy of using modern-day slave-labour10 in low-tax special economic zones in places like Indonesia11.12

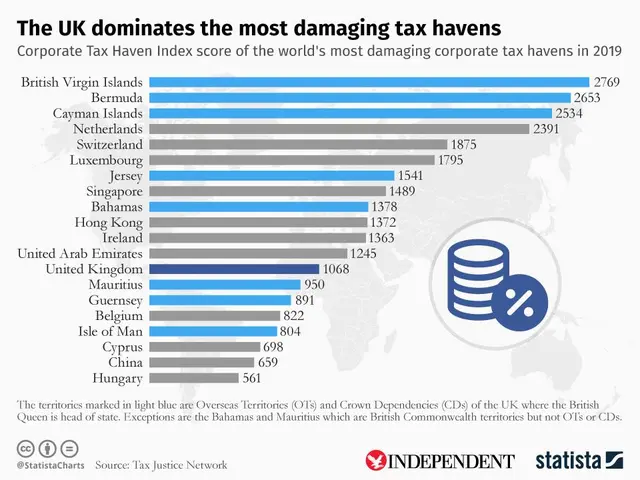

Tax havens can be found in Panama3,13, the Netherlands3,14, Malta3, the Cayman Islands3,13, Guernsey13,15, Jersey13,15, the British Virgin Islands3,15, the USA's states of Delaware, Wyoming, Nevada and South Dakota plus Puerto Rico13; the Isle of Man13, Mauritius3, Bermuda3,13, the Bahamas13, Ireland16, Luxembourg13, Macao13, Singapore13 and Switzerland13. They support the same financial schemes that also allow organized criminals, drug lords, violent gangs and terrorist groups to launder money.

The complexity of taxes, and the international flows of money, mean that it has moved beyond the ability of any government to fix the problem of tax evasion on its own17,18,19,4. Co-operation is the only possible way to collect tax from the reluctant wealthy, selfish corporations, and antisocial criminal gangs. Since the late 2010s, a multinational scheme saw banks in over 140 places begin to share banking information to catch tax cheats and "offshore tax evasion has declined by a factor of about three in less than 10 years"20 but still, the rich and powerful manage to pay less than struggling citizens20.

- Tax Evasion, Tax Avoidance, Tax Havens

- The Rich

- Organized Crime

- Multinational Corporate Tax Evasion

- Tax Havens and Similar Locations

- International Responses

- Links

1. Tax Evasion, Tax Avoidance, Tax Havens

#cayman_islands #tax #tax_evasion

The phrase Tax Avoidance covers the reluctant fact that the rich largely avoid paying taxes through legal means21 - loopholes - which mostly result from the immense complexity of multinational finance. Tax Evasion is when people - normally somewhat less rich - try to accomplish the same thing, but don't manage to do so legally22. In both cases, the intent is the same, and it's right to use the terms synonymously.

Tax Havens are the key method by which the rich avoid taxes, and by which criminals and organized crime syndicates hide their money from authorities. These are places where the law permits 'shell companies' to operate without being substantially present, either in terms of real trade or staffing. Smoke and mirrors, to enable corporate secrecy.

The core of Tax Havens are shell companies or offshore companies. Moving corporate finances to offshore shell companies, with a board of directors mostly made up of foreign nationals, allows wealth to be moved around silently and without taxation. It often requires anonymity, so that the boards of directors are comprised of fake people. E.g., there is a single building in the Cayman Islands that is host to 19,000 companies3.

2. The Rich

#angola #iceland #nigeria #pakistan #tax #tax_evasion

The rich, who can afford to pay more tax, also have the ability to pay much less3; billionaires manage "between 0% and 0.5% of their wealth" which is "significantly lower than those of all other groups of the population"; they achieve this through using wealth-holding shell companies to avoid paying income tax, receiving dividends from those companies instead1. They fall victim to the mentality that they must accumulate as much as possible, in a battle and a race against their peers, no matter what they deprive others. The world's billionaires number fewer than 3000 and their wealth grows at about +7% (after inflation); even a modest international taxation scheme of 2% would restore $250 billion in lost taxes20.

Being kind, it is possible to imagine that many of them don't understand the harm that they are doing. But the systems that they use - the accountants and those who facilitate shell companies - are the same people that criminals and violent gangs use to launder money. It's all the same dark finance. Putting it unkindly, it is possible to imagine that many of them simply don't care about the negative consequences of the way they use their financial skills.

“The wealthy keep the money to build intergenerational fortunes, creating a new global aristocratic class and exacerbating the divide between the global haves and have-nots.

Politicians, like Iceland´s former prime minister, Sigmundur David Gunnlaugsson, and Nigeria's former senate president, Bukola Saraki, have concealed investments or luxury homes with the help of shell companies. So have their children. Notables include the son and daughter of former Pakistan prime minister, Nawaz Sharif, and Isabel dos Santos, the billionaire daughter of former Angolan strongman president, Jose Eduardo dos Santos.”

International Consortium of Investigative Journalists (2020)3

“Global billionaires have very low personal effective tax rates, of between 0% and 0.5% of their wealth [and] significantly lower than those of all other groups of the population"; they achieve this through using wealth-holding shell companies to avoid paying income tax, receiving dividends from those companies instead.”

"Global Tax Evasion Report" by EU Tax Observatory (2024)1

3. Organized Crime

“Drug lords and ladies, bank robbers and arms traffickers, mafia kingpins and queens and bribe takers and makers also use shell companies to obscure their identities and conceal money, assets and illicit activities.”

International Consortium of Investigative Journalists (2020)3

4. Multinational Corporate Tax Evasion

#civilisation #crime #governance #indonesia #multinationals #tax #tax_evasion #tax_havens #USA

Large multinationals excel at tax evasion4. They do it by exploiting holes between tax jurisdictions4, by making their accounting artificially complicated7, and by hiding profits in low-tax countries (at a rate of $1 trillion per year)8, causing true damage to democracies and developing countries alike and causing grievances and resentment5. They stubbornly resist even the most determined international pressure groups, and only change their ways if forced to when multiple governments co-operate to fix tax holes - their ordinary response is to find new tax havens. The USA's multinationals are the most selfish, hiding about half of their profits, whereas the average for the rest of the world is 30%8.

There are many companies well-known for tax evasion; including tech giants from Silicon Valley - Amazon, Apple, Facebook, Google, Microsoft and Netflix7,9. Nike too3, and, the fashion and textile industry as a whole has produced a long and terrible legacy of using low-tax special zones in places like Indonesia where produce is made in factories using modern-day slave-labour10,11. Consumers face an almost impossible task of trying to narrow down choices to an elusive list of small and hard-to-find ethical companies.

For more, see:

5. Tax Havens and Similar Locations

#Andorra #bahamas #bermuda #british_virgin_islands #cayman_islands #ireland #Liechtenstein #malta #mauritius #Monaco #netherlands #niue #panama #tax_evasion #UK #USA #vanuatu

Some small nations exist almost purely as tax havens; whereas some countries (such as the UK15) are responsible for multiple territories that act as tax havens. Some of the most notorious places responsible for hiding the moneys of the rich, the powerful, and the corrupt; are Panama3,13, the Netherlands3,14, Malta3, the Cayman Islands3,13, Guernsey13,15, Jersey13,15, the British Virgin Islands3,15, the USA's states of Delaware, Wyoming, Nevada and South Dakota plus Puerto Rico13; the Isle of Man13, Mauritius3, Bermuda3,13, the Bahamas13, Ireland16, Luxembourg13, Macao13, Singapore13 and Switzerland13..

Source:The Independent (2019)14

“An index published [in 2019] by the Tax Justice Network found that the UK has single-handedly done the most to break down the global corporate tax system which loses an estimated $500bn (£395bn) to avoidance. [...] Tax haven territories linked to Britain are responsible for around a third of the world´s corporate tax avoidance risk - more than four times the next greatest contributor, the Netherlands.”

The Independent (2019)14

The abuses are clear, but the governments involved do not want to act. even when the evidence is screaming out that abuses are in progress - there is a single building in the Cayman Islands that is host to 19,000 companies3: Only when the public outcry is loud enough to force companies to change, do the governments belatedly patch up their legal systems.

Liechtenstein, Andorra and Monaco were on the OECD's blacklist of uncooperative tax havens, but positive reforms meant that come 2009, all three were removed23.

“Some tax havens, like Niue and Vanuatu, have cleaned up their act under international pressure while others, like Dubai, are emerging as new hotspots of illicit wealth.”

International Consortium of Investigative Journalists (2020)3

6. International Responses24

#british_virgin_islands #EU #globalism #guernsey #internationalism #ireland #jersey #tax #tax_evasion #UK

The complexity of taxes, and the international flows of money, mean that it has moved beyond the ability of any government to fix the problem of tax evasion on its own17,18,19,4. Co-operation is the only possible way to collect tax from the reluctant wealthy, selfish corporations, and antisocial criminal gangs.

“Tax evasion and avoidance are made easier by insufficient information, by the rise of large digital companies operating across tax jurisdictions and by inadequate interjurisdictional cooperation. In these policy domains international collective action must complement national action.”

United Nations Human Development Report (2019)4

The governments of the EU bloc lose about €1 trillion annually to tax evasion19 and although the EU has made several attempts to harmonize tax laws and therefore make it harder for criminals and corporations to hide money, some member states have resisted these moves. Most notably, Ireland16; and the UK, which shielded several of its own tax havens15,16,14. Within a month of the UK leaving the EU, the European Parliament voted (in 2021 Jan) to add the British Virgin Islands, Guernsey and Jersey to its tax havens blacklist15. Several well-established EU norms and rules on tax transparency related to the shoring-up of weak laws amongst member states, and the sharing of information for the ends of ending tax abuses.

In the past decade, international co-operation has resulted in some schemes that have equalized the playing field, and therefore, reduced tax evasion.

“Over the last 10 years, governments have launched major initiatives to reduce international tax evasion. These efforts include the creation of a new form of international cooperation long deemed utopian - an automatic, multilateral exchange of bank information in force since 2017 and applied by more than 100 countries in 2023 - and a landmark international agreement on a global minimum tax for multinational corporations, endorsed by more than 140 countries and territories in 2021. [... Thanks to this], offshore tax evasion has declined by a factor of about three in less than 10 years.”

"Global Tax Evasion Report" by EU Tax Observatory (2024)20